I thought for this Luxury Travel Masterclass I would show you how to gain Gold or Platinum status with hotels without even staying a night plus gain 30,000 avios points all thanks to the nifty little American Express Platinum Credit Card. My favourite hotel chain is IHG but sometimes I feel the need to sleep around a bit but I don’t want to lose my IHG benefits.

^^The Old Cataract Hotel which is an Accor Hotel.

Once again this is geared towards hotels in a chain which I know travellers don’t really like but I’ve found some of my favourite hotels have been part of a loyalty scheme so don’t judge a book by it’s cover.

Let me introduce you to the American Express Platinum Express Credit Card – and yes almost all my Masterclasses will be linked to a credit card, this is how you’re going to earn points and get instant status easily which will get you free nights or free flights and lust worth upgrades!

Welcome Point Bonus

The Platinum American Express Card offers you a rather lovely 30,000 points if you spend £2,000 on it’s card within the first 3 months of joining up…it’s totally doable if you pay for all your food shopping, bills and all your clothes and shoes purchases….a lot more retailers accept AMEX these days.

These 30,000 points can be turned into 30,000 avios points and are easily transferred over to your BA Executive Club Account along with any other points you’ve earned while having the card.

You can also transfer these points over to the following award programs –

Airline – Air France KLM Flying Blue, Alitalia MilleMiglia program, Asia Miles, British Airways Executive Club, Delta SkyMiles, Emirates Skywards, Etihad Guest, Finnair Plus, Iberia Plus, SAS EuroBonus, Singapore Airlines KrisFlyer, and Virgin Atlantic Flying Club.

Hotels – Club Carlson, Hilton HHonors and Starwood Preferred Guest

Hotel Loyalty Programs

So you can apply and get instant status with three large hotel chains once you’ve received your American Express Platinum Credit Card…I’ve only used two of these memberships so far.

Starwood Preferred Guest (SPG) Gold Status – I like this membership a lot and I’d wanted to stay at a SPG hotel for a while but as I’ve said earlier I still wanted my late check out.

So what do you get for being a Gold member – late check out, free wifi and sometimes free breakfast.

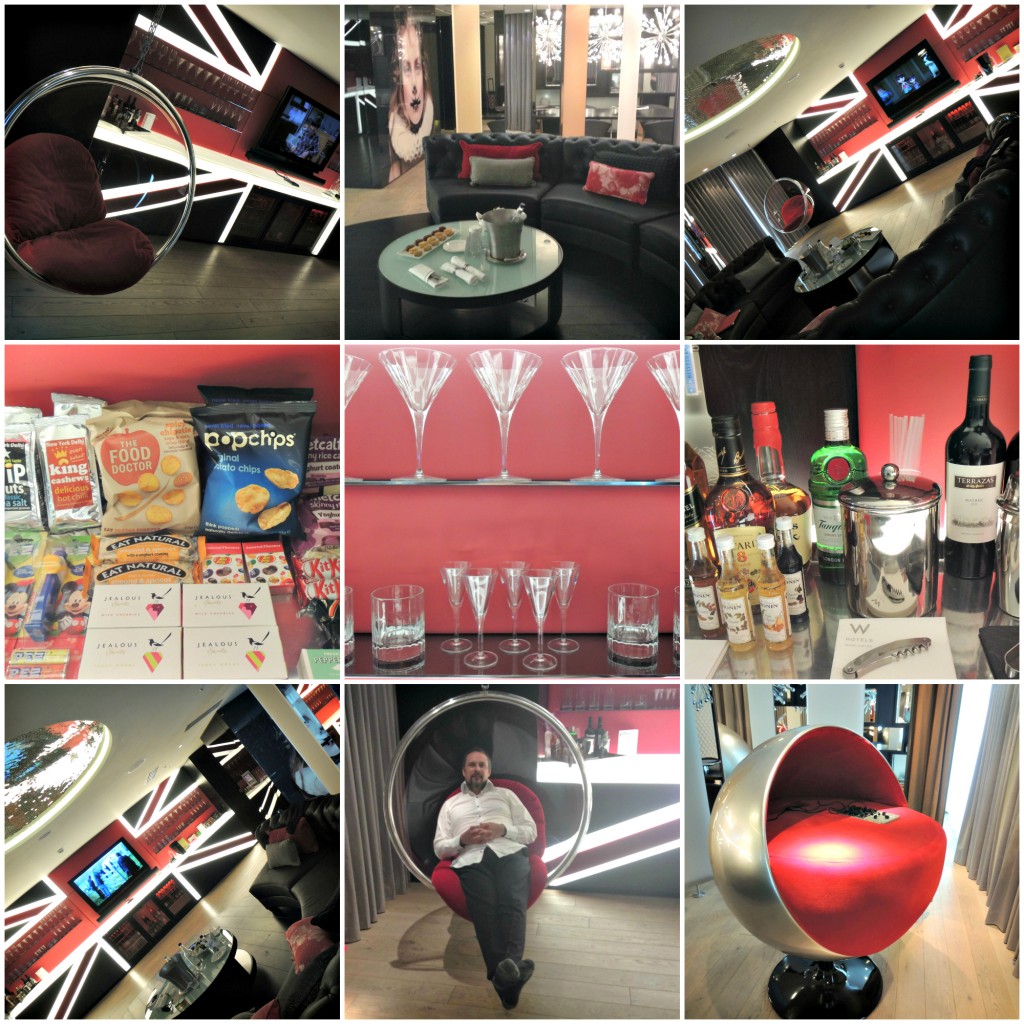

SPG covers a number of different hotel groups including the Luxury Collection hotels (my favourite, I love classic old hotels!), the rather funky W Hotels, Aloft Hotels, St Regis and the very business like Sheratons.

So far I’ve stayed at the Grande Bretagne in Athens and we really enjoyed our stay at this Luxury Collection hotel…

…and we scoffed afternoon tea of course! G actually rates the scones at the Grande Bretagne as the best in the world…he eats as much afternoon tea as me so I think he’s allowed to make this big call.

Then there was that huge suite at the W Hotel in London where G almost had kittens when he saw that the suite had it’s own fire escape!

Le Club Accorhotels Platinum Status – now I’ll be honest and say I have a total love hate relationship with this hotel chain and their loyalty scheme and I will do a huge round up on the Accor hotels next.

So what do you get for your platinum status – possibly a chance of a late check out, possibly a room upgrade, possibly a welcome gift, really slow wifi and possibly a free welcome drink – can you see that I’m possibly not a huge fan of the Accor group.

Accor Hotels covers the McGallery Hotels, Sofitel, Sofitel Legende Properties, Novotel, Ibis and Mecure hotels so a great selection of budget hotels right through to the more luxurious.

I’ve stayed at the Paris Sofitel…

…Sofitel Legend Old Cataract Hotel in Aswan which was the whole reason for our trip to Egypt; yes crazy I know and don’t panic it wasn’t my first time in Egypt, it was my third…

…and to scoff afternoon tea with the best view in the world!

Club Carlson Gold Status – I’ve yet to stay in one of the Club Carlson hotels with this loyalty card so can’t really comment too much however the chain includes the Radisson, Park Inn’s and Park Plaza – I’ve stayed in the first two hotels many years ago and they’ve always been clean and tidy.

Earning Potential

You will only earn 1 point for every £1 spent so not a great deal compared to what you can get if you’re looking at converting these points over to avios – the BA American Express card that I talk about here offers a much higher number of points per £1 spent.

Airport Lounge Access

In the past, the Platinum American Express Credit Card used to give members instant Gold Cathay Pacific Membership which was equivalent to Silver Membership with British Airways hence you got free entry to the BA lounges when flying Economy right through to First Class – this cheeky little benefit has now gone…boo!

But what you get now is access to any Priority Pass Lounge around the world for you and one guest which is better than a kick in the head. If you’ve entered a Priority Pass Lounge you will probably realise that they’re not the flashiest of lounges around but they do offer a little bit of a sanctuary in an airport or when travelling on the Eurostar – as G tells me; if you’re in the lounge then you aren’t duty free shopping.

Saying that, I like the Aspire Lounge at Luton Airport and their gluten free offerings are definitely a lot better than what I get offered at any BA lounge!

Travel Insurance

Travel Insurance is included with the card however if you cancel the card then I would be wary if you’re still covered – you should always travel with insurance, never leave home without it! Just ask G about all this travel insurance stories…like when he was airlifted from Malawi to South Africa or the time that he had £100,000 worth of medical treatment in Cyprus due to Compression Sickness…we never leave home without it!

Membership Fee

Okay here is the scary bit…the annual fee is £450! And you have to pay that on the very first month but here’s how to get all the above benefits for only £112.50.

- As soon as you receive the card, try and spend the £2,000 in the very first 3 months to get the welcome bonus of 30,000 points.

- You will have to pay the £450 membership fee in the first month remember this!

- Sign up to all the loyalty schemes in the first month and make sure that they’ve all come through.

- Transfer the welcome bonus to your preferred loyalty scheme – I transferred my 30,000 points over to the BA Executive Club to get 30,000 avios points to use towards my free first class flight. You will have more than 30,000 points as you would have earned at least 2,000 points from the £2,000 spend.

- One the 1st day into the fourth month, contact American Express and request them to cancel your credit card…they will obviously try and keep you but just cut them off politely and tell them that you have another card.

- American Express will then refund 3/4 of the £450 membership account either to another American Express Card or they will transfer you the money.

You can then reapply for this card again in just over 6-9 months time so that you can renew all your loyalty schemes plus gain another 30,000 points when you re-apply!

The Important Facts

- Never get yourself into debt just to get yourself free hotels and flights

- As this is a charge card and not a credit card, it needs to be paid off in full each month

- You need to earn more than £40,000 to be able to apply for this card

- There is no spending limit!

You can read more about the American Express Platinum Credit Card here.

xx

If you liked this post on a Luxury Travel Masterclass: The American Express Platinum Credit Card then why not come and join me on Twitter, Google+, Instagram, Facebook and Pinterest – I won’t bite!